Estate Planning

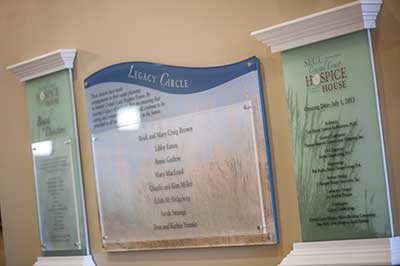

Joining our Legacy Circle means you have made arrangements in your estate planning to benefit Crystal Coast Hospice House. CCHH reserves a special honor for our Legacy Circle donors. Planned gifts, such as those listed below, may offer ways to meet your personal financial goals and support your hospice home.

Joining our Legacy Circle means you have made arrangements in your estate planning to benefit Crystal Coast Hospice House. CCHH reserves a special honor for our Legacy Circle donors. Planned gifts, such as those listed below, may offer ways to meet your personal financial goals and support your hospice home.

There are many opportunities to plan a future gift to Crystal Coast Hospice House. These may offer immediate tax benefits or future tax benefits to you and your family. Please feel free to contact Kay Coole, Executive Director at [email protected] or phone at 252.808.2244, about these opportunities and discuss the benefits with your financial advisors. CCHH staff are not estate planning experts, so any planned gift should be reviewed by your financial advisors to ensure the most benefit to you. We are available to meet with you and your advisors to discuss these opportunities.

To include Crystal Coast Hospice House in your estate plans, you may need the following information:

Name of Organization: Crystal Coast Hospice House

Mailing Address: PO Box 640, Newport, NC 28570

Physical Address: 100 Big Rock Weigh, Newport, NC 28570

EIN: 26-2806108

NC Charitable Solicitation License: SL005987

The information above is available in a downloadable document here.

Please download and provide the Notification of Intent to CCHH so we may include you in our Legacy Circle. If you prefer to remain anonymous, your Statement of Intent will only be used for future financial projections by CCHH.

Leaving a Legacy

Bequest in Will allows you to provide a gift for CCHH in your will and may offer an estate tax deduction for the value of your bequest to CCHH. A Bequest offers you flexibility in providing for your family's needs first.

A gift of Life Insurance, whether through an old policy or a new one, names CCHH as the policy beneficiary and offers immediate income tax deductions for the premium payment, plus possible estate tax savings. A Life Insurance gift provides a way to make a significant gift with nominal expenditure.

A gift through your Retirement Plan, by naming CCHH as a beneficiary of your IRA or 401(k), can offer tax deductions on the plan in addition to possible significant estate tax savings if the assets are distributed to individuals other than your spouse.

Charitable Remainder Trusts may be established with a gift of cash or appreciated asset. These trusts pay income to you or those you name for life or a term of years before CCHH receives the remainder. You may receive income tax savings and possible estate tax savings. A Charitable Remainder Trust provides annual income for the donor or other beneficiary.

Charitable Lead Trust pays income to CCHH for a period of years determined by you before you or your heirs receive the remainder. It may offer gift or estate tax savings for the value that CCHH received. A Lead Trust allows you to pass assets to your heirs, intact, with a reduced tax obligation.